How do I get the highest savings rate?

Earn highest savings rate

If you want to fast track your savings so you can get to your goals sooner, it could pay to earn Savings Maximiser’s highest available variable rate.

Here’s how to earn it

To earn our highest available variable rate you need both a Savings Maximiser and Orange Everyday account, then each month do all of these

How our highest available variable rate is applied

Our highest available variable rate is applied in the calendar month after you’ve met the eligibility criteria.

So if you continue to meet the criteria each month, you’ll continue earning our highest rate every month on your nominated Savings Maximiser account for balances up to $100,000.

You’ll receive the standard variable rate on any amounts above this.

How to keep track of your eligibility

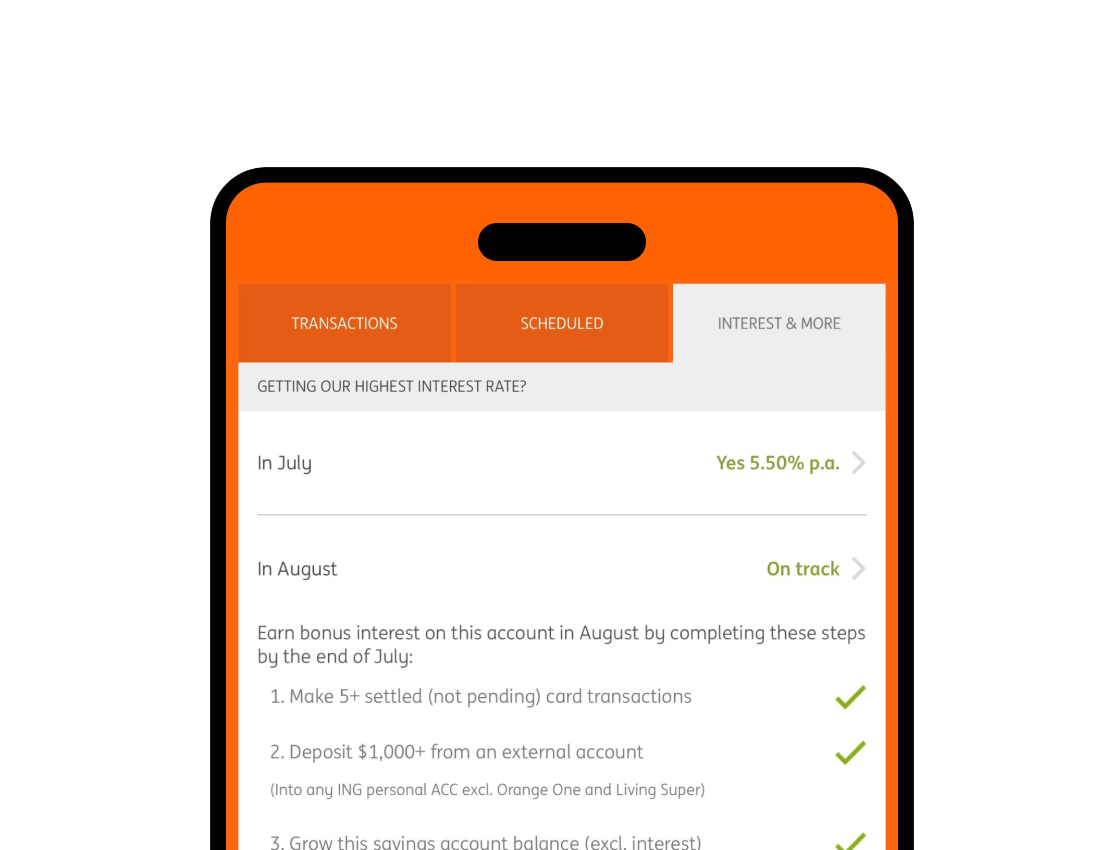

You can check your own eligibility status for the current and next month using the ING app or online banking.

How settled card purchases are calculated

The following card transactions count towards the 5 settled (not pending) card purchase minimum each month when made with Orange Everyday, Orange One Low Rate or Orange One Rewards Platinum and Nil Interest Visa card (with eligible ING home loans):

- In-store credit or EFTPOS purchases

- online purchases

- regular card payments

- payWave

- Apple Pay

- Google Pay

- Direct Debits using a card number

- PayPal transactions using a card number.

Card purchases exclude ATM withdrawals, balance enquiries, cash advances, BPAY transactions, direct debits using an account number, EFTPOS cash out-only transactions and any transaction that does not use a card number.

When using the phrase ‘settled’ card purchases in a calendar month, we mean that the purchases made on your card must be fully processed by the end of the last day of that month. Card purchases made in store or online this current calendar month which are at a ‘pending status’ and do not settle until the next calendar month do not count towards the 5 card purchases needed this current calendar month.