Switch your pay to Orange Everyday.

How to switch your pay:

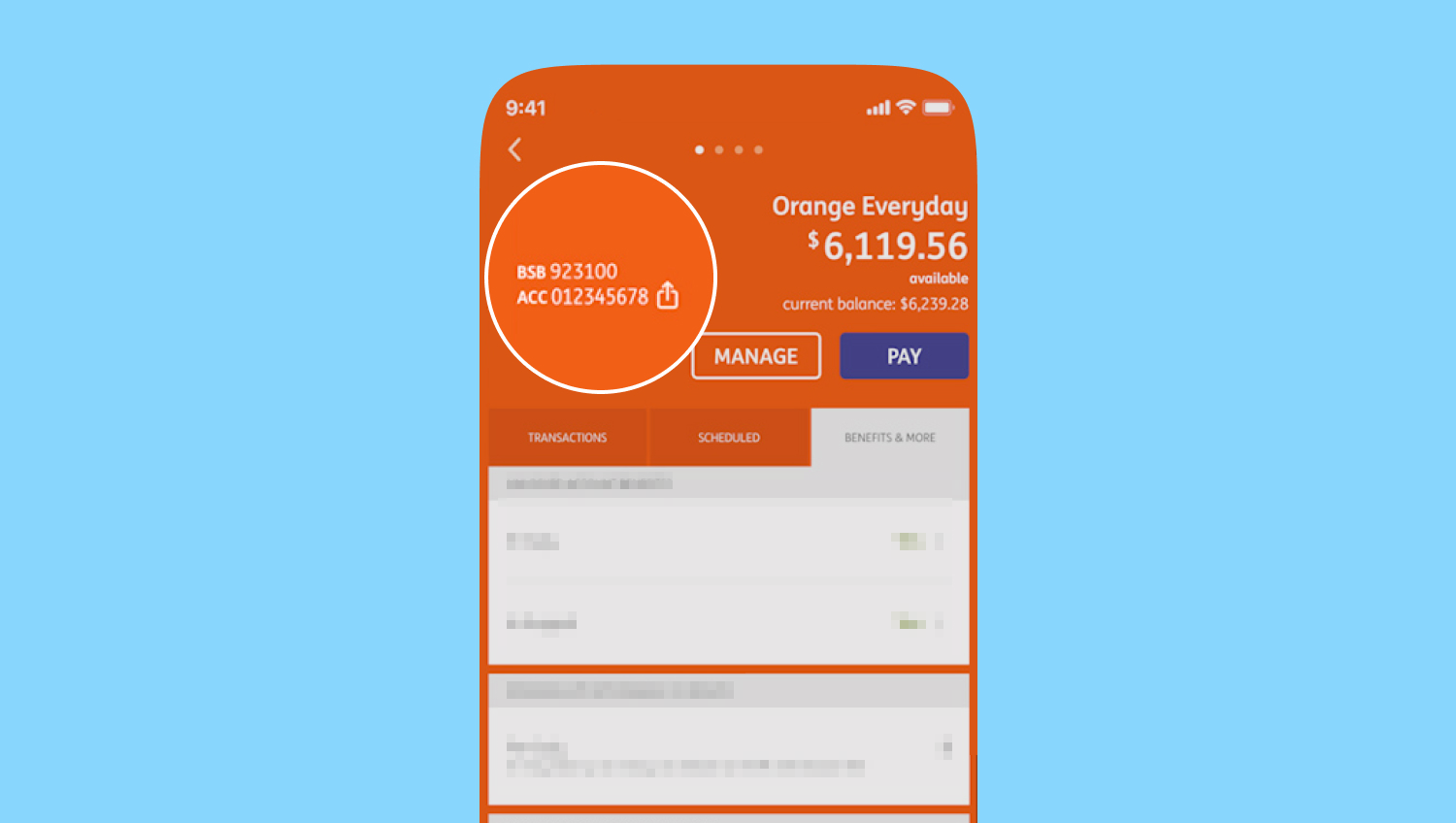

Simply tell your employer you want to have your pay deposited into your Orange Everyday and give them the details below:

- our BSB – that’s 923 100

- your Orange Everyday account number (you can find this in the ING app or online banking)

You can also download and complete our simple salary deposit form and share this with your payroll peeps so they can set it for your next payday.

More ways to save

Just by having an Orange Everyday, you get to bank these benefits:

Earn bonus interest on your savings too

If you have a Savings Maximiser, you could also earn bonus interest on top of the standard rate when you grow your nominated Savings Maximiser balance each month (excluding interest) in addition to the Orange Everyday monthly eligibility criteria.

Earn up to % p.a.

% p.a. additional variable rate + % p.a. standard variable rate

Available on one account for balances up to $100,000, it’s a smart way to fast track your savings so you can do even more of your thing, even sooner.

Not a Savings Maximiser customer?