5 Simple steps to tackle tax time.

Dust off that receipt pile and open your best spreadsheet cause it’s time to ...

Scammers are becoming more sophisticated and some are even trying to impersonate

ING. But unlike us, they don’t have your best interests at heart. So, beware of imposters. Here’s what to watch out for and how to help keep yourself scam safe.

An impersonation scam is when a scammer poses as a trusted individual or organisation – like ING – to trick you into handing over your details or money.

Sometimes they’ll say a transaction or your account has been blocked and you need to provide your info or click a link to fix it. Scammers may even ask you transfer money – DON’T!

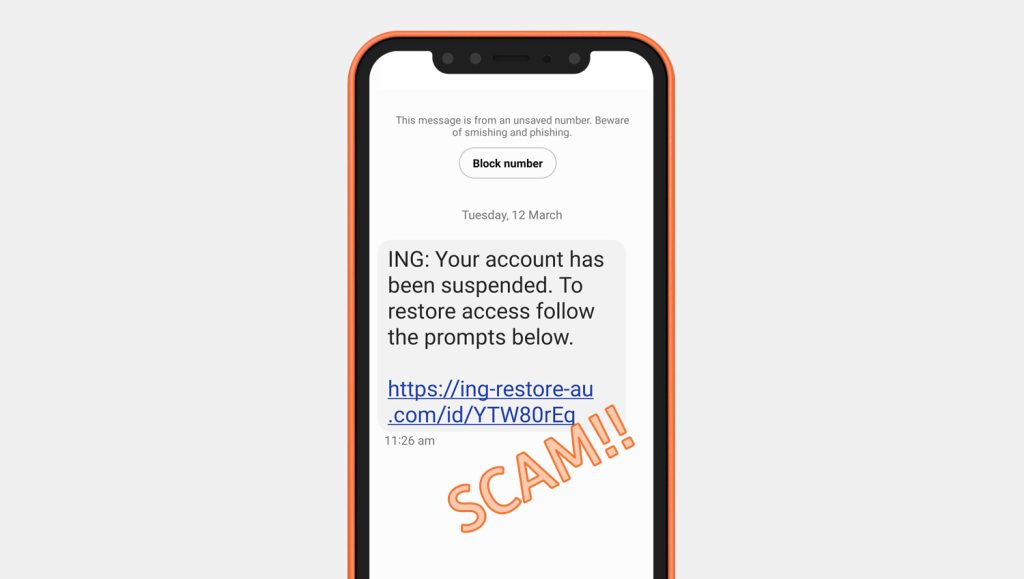

One morning ING customer Sue* received an SMS that looked like it came from ING.

It said her account had been suspended and she needed to follow the prompts by clicking a link in the message.

Luckily, Sue noticed the SMS came from an unknown number and didn’t include the usual ING contact details.

Instead, she used her ING app to check her Orange Everyday was still active.

She then called ING to report the scam.

* Name changed for privacy.

Every crime has its modus operandi, so here are some clues to look out for:

To help avoid an ING impersonation scam you should:

Whatever the type of scam, keeping these simple steps top of mind could help prevent you from becoming a scam statistic.

For our latest security alerts and more ways ING can help to protect you and your money, visit ing.com.au/security.

The information is current as at publication.

Any advice on this website does not take into account your objectives, financial situation or needs and you should consider whether it is appropriate for you. Deposit products, savings products, credit card and home loan products are issued by ING, a business name of ING Bank (Australia) Limited ABN 24 000 893 292, AFSL and Australian Credit Licence 229823. Living Super, a sub-plan of OneSuper ABN 43 905 581 638 is issued by Diversa Trustees Limited ABN 49 006 421 638, AFSL 235153 RSE L0000635. The insurance cover offered by Living Super is provided by Metlife Insurance Limited ABN 75 004 274 882, AFSL 238096. ING Insurance is issued by Auto & General Insurance Company Limited (AGIC) ABN 42 111 586 353 AFSL Licence No 285571 as insurer. It is distributed by Auto & General Services Pty Ltd (AGS) ABN 61 003 617 909 AFSL 241411 and by ING as an Authorised Representative AR 1247634 of AGS. All applications for credit are subject to ING’s credit approval criteria, and fees and charges apply. You should consider the relevant Product Disclosure Statement, Terms and Conditions, Fees and Limits Schedule, Financial Services Guide, Key Facts Sheet and Credit Guide available at ing.com.au when deciding whether to acquire, or to continue to hold, a product. Before interacting with us via our social media platforms, please take a minute to familiarise yourself with our Social Media User Terms https://www.ing.com.au/pdf/Social_Media_User_Terms.pdf.