What is ‘Know Your Customer’?

Keen to understand a little more about our policy? Head here. It will ...

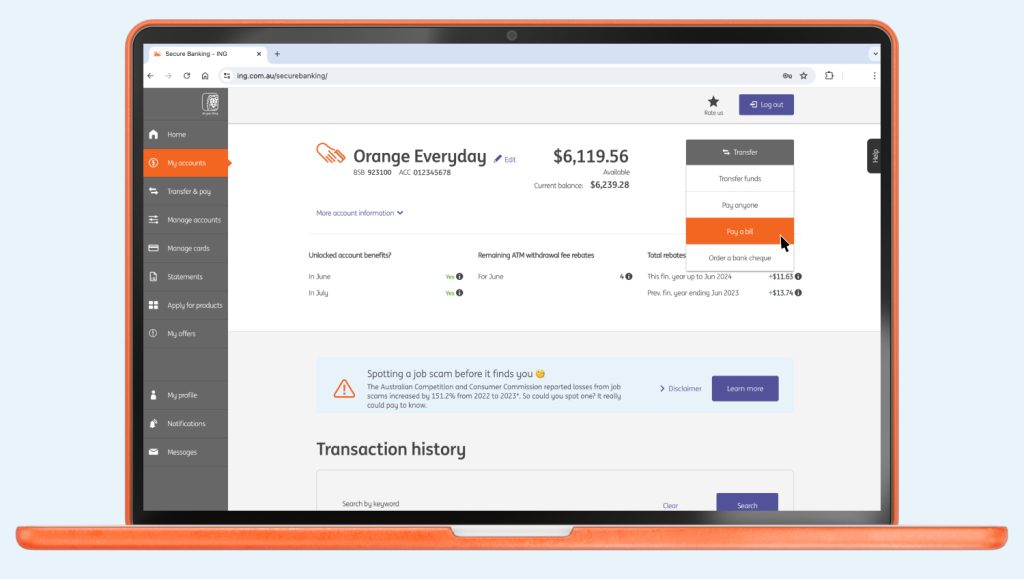

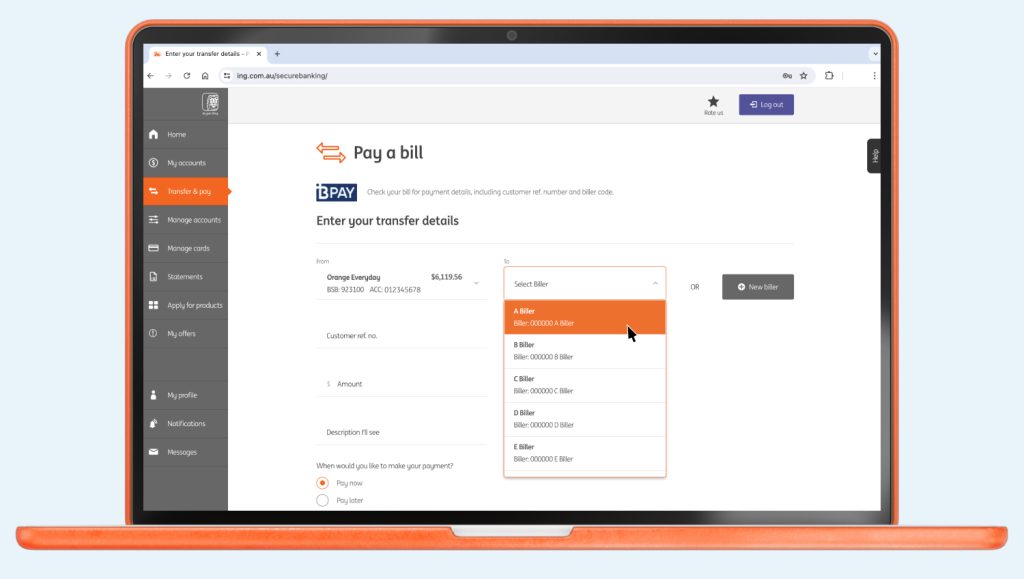

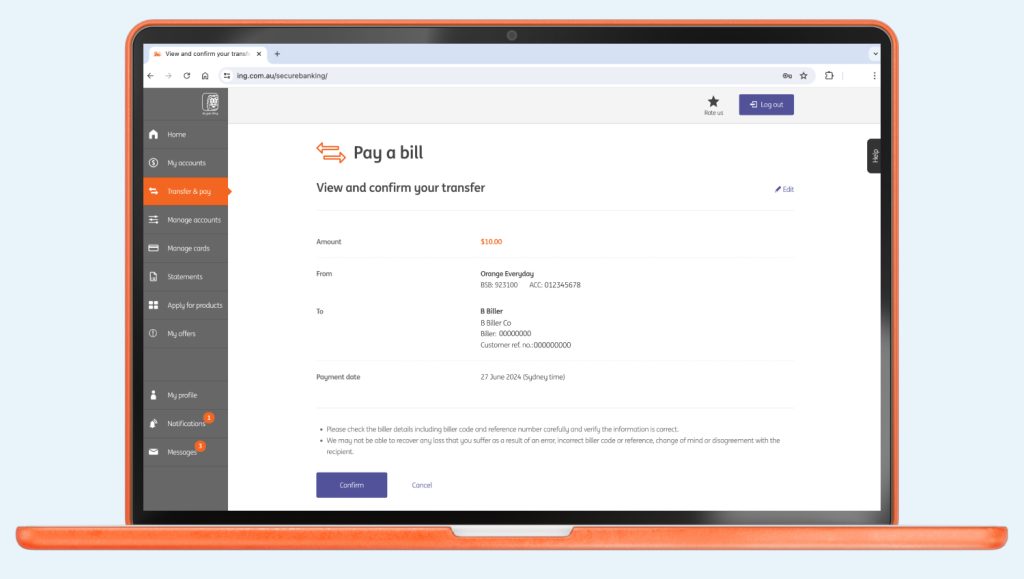

BPAY® helps you pay your bills easily and securely on your ING App or in Online Banking.

Pro Tip: If it’s a regular ongoing bill you can choose recurring when making the payment and put your BPAY payments on autopilot. Just tap When? and select Recurring payment. Select the Payment frequency, Start date and Payment schedule and then tap Pay.

Get 1% cashback on eligible gas, electricity and water bill payments made from your Orange Everyday account using BPAY (T&Cs apply).

Click the link below to see if your household gas, water and electricity suppliers are included. We have most Australian utility suppliers covered.

You must make the BPAY transaction before 4pm (AEST/AEDT) on a business day for BPAY to receive the funds from ING the very same day.

BPAY will then forward the funds to the Biller which may take 2 to 3 business days to reach the biller.

BPAY® is a registered trademark of BPAY Pty Ltd ABN 69 079 137 518.

Orange Everyday utility bill offer

1% cashback on eligible utility bill payments, up to $100 per Orange Everyday, per financial year. An eligible utility bill payment is a payment made by BPAY, direct debit (BSB and account number), or PayTo from your Orange Everyday account for a water, gas or electricity bill from an agreed supplier for the Australian residential address of the account holder.

For full terms and conditions, see the Orange Everyday Terms and Conditions and Fees and Limits Schedule, Orange Everyday Target Determination and the agreed utility supplier list at ing.com.au.

Subject to these terms and conditions, ING may change or cancel these benefits at any time.