Keep your identity safe this tax time.

In today’s digital world, scammers can quickly change their methods to trick you into ...

Scammers are constantly coming up with new tricks to lure people in.

We all know that scam about the foreign prince who says he ‘needs your help to transfer money in exchange for a large inheritance.’ Or the classic con about the lottery prize you’ve won where you need to hand over your bank details to collect your winnings.

But scams aren’t always plain to see – there are lots of sneaky ways cyber criminals can catch you out. And with the Australian Competition and Consumer Commission (ACCC) reporting that scams are on the rise, it’s good to stay in the know with the cyber dark arts so you’re ready to spot them.

Let’s take a look at the basics of staying secure online, some common scams you should be on the watch for and how we can help if you think you’re the victim of a scam.

Securing your devices

The first place to start is right under your nose. Spyware and malware can snoop on your internet activities on your phone and computer.

Here are some tips to protect your devices:

Think cyber-secure and act cyber-secure

As well as keeping your software up to scratch, there are some habits you should try to adopt.

When you’re working or banking online, make sure your network connection is secure. Keep in mind that a lot of people can access the free wi-fi at your local cafe, so it could potentially leave you exposed to threats.

Avoid opening emails from unknown sources that you aren’t expecting – especially if they ask you to open an attachment. This is the oldest trick in the book for cyber criminals who are looking to infiltrate your devices and systems.

And instead of using USB sticks to transfer files, consider switching to cloud-based software.

Phishing scams

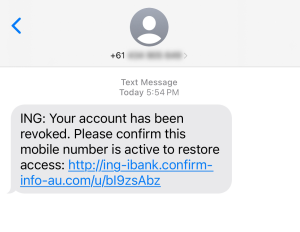

Phishing is where criminals attempt to get your personal details – like bank account numbers, credit card numbers and most importantly your passwords – usually by portraying themselves as a trustworthy and genuine source through an email or text.

Phishing messages are designed to look genuine and will copy the format used by the organisation that the scammer is pretending to be from. Victims might fall for this scam if they click on any links or attachments within the email or text.

Here are some signs that you might be looking at a phishing scam:

You should also watch out for pop-up ads on websites and unusual messages from people you don’t know in your social media accounts – these are other common phishing tactics.

ING will never send you an email or SMS asking for your login details.

| How phishing text messages work

Sally* received an SMS saying it was from ING. It advised of a transaction she didn’t recognise and instructed her to click a link to login to online banking using her customer and access codes. She then received a call from someone who said they’re from ING and were calling to verify a fraudulent transaction. Sally then received an SMS code and the caller asked her to confirm the code which is her ‘reference number’ for stopping or replacing her card. Sally was suspicious, hung up and called ING to see if we called. We were able to verify it was a scam. |

*Name changed for privacy.

Investment scams

Investment scams are where scammers contact you claiming to be stockbrokers, crypto brokers or portfolio managers with an unbelievable investment opportunity.

Scammers will ask you to hand over money for an investment opportunity that offers a high rate of return usually with the need to act fast so you don’t miss out.

They may even provide prospectus documents that appear to be legitimate or impersonate real financial intuitions.

If you come across an investment opportunity, always seek independent financial advice before investing.

Romance scams

Romance scams are where scammers form a relationship with you to get money or gifts.

They usually develop the relationship over time, often through social media, and may ask you to transfer assets into their name or ask to become a beneficiary of your will.

They may ask for money to assist with a health, travel or family problem. In many instances, they’ll find reasons to only communicate by email to avoid any live video chats.

Most times the person is not who they claim to be and may even be part of an organised crime.

Unsolicited phone calls

Sometimes a scam will start with a phone call you didn’t ask for, from a person or company you don’t know.

Here are some examples of unsolicited phone scams:

| Tom* received a call from scammer posing as X Bank. He responded by telling them he didn’t have an account with X Bank but he did have one with ING. The caller then said they’re calling from ING. Tom was suspicious, hung up and called ING to check if we had called. We were able to verify it was a scam. |

*Name changed for privacy.

If in doubt, always hang up and call the company’s official phone number – like the one advertised on their website – to confirm they called you. However, be wary if you’ve never heard of the company before because the website may also be fake!

Skimming

Skimming is where your debit or credit card details are stolen, often using a hidden device that reads – or ‘skims’ – your card’s magnetic stripe and records your PIN entry.

For example, a device might be placed over the top of the card reader at an ATM to try and record your account numbers. We suggest you cover your hand as you enter your PIN to prevent recording of your PIN details.

You can try to avoid the problem by making it harder for criminals to steal your details.

For instance, choose ATMs that are in secure locations, like attached to a bank. Also, look to see if something is attached to the card reader. If it’s loose, there’s a good chance it’s dodgy. And when shopping, try to do your transactions using the chip on your card.

If you think that you’ve been skimmed, call the ATM’s bank – and ING – straight away.

Porting

Porting is when someone steals your personal details so they can transfer your mobile phone number to their control and access your accounts.

Scammers can do this by pretending to be you and either setting up a new account with a new phone company or contacting your current provider and requesting a new SIM card.

A scammer can then use your stolen mobile phone number to receive SMS verification codes that allow them to access your services, such as your bank, email and social media accounts.

You’ll know your phone number has been ported if you suddenly can’t make or receive calls or messages and your phone goes to ‘SOS only’ when everyone else has reception.

Here are some tips to prevent porting:

Want the facts, fast? No problem. For what to avoid and how we can help if you think you’ve been scammed, check out this quick video.

We’re here to help

If you’ve lost your card, you can use the ING mobile banking app or online banking to put your card on hold. This gives you time to find it without worrying if someone else might be trying to use it. Once your card’s been found, you can breathe a sigh of relief – and then take it off hold. If you’re suspicious of someone who’s contacted you,

notice unusual account activity on any ING account or think you might have been scammed call our dedicated scams line anytime 24/7 on 1800 052 743.

For more on how we help protect your banking and details of the latest scam threats affecting ING customers, visit ing.com.au/security

ING does not endorse and is not affiliated with third parties mentioned in this article. ING is not responsible for any services provided by third parties nor does ING accept any liability or responsibility arising in any way from any products or services supplied by the third parties.

The information is current as at publication. Any advice on this website does not take into account your objectives, financial situation or needs and you should consider whether it is appropriate for you. Deposit products, savings products, credit card and home loan products are issued by ING, a business name of ING Bank (Australia) Limited ABN 24 000 893 292, AFSL and Australian Credit Licence 229823. ING Living Super (which is part of the ING Superannuation Fund ABN 13 355 603 448) is issued by Diversa Trustees Limited ABN 49 006 421 638, AFSL 235153 RSE L0000635. The insurance cover offered by ING Living Super is provided by Metlife Insurance Limited ABN 75 004 274 882, AFSL 238096. ING Insurance is issued by Auto & General Insurance Company Limited (AGIC) ABN 42 111 586 353 AFSL Licence No 285571 as insurer. It is distributed by Auto & General Services Pty Ltd (AGS) ABN 61 003 617 909 AFSL 241411 and by ING as an Authorised Representative AR 1247634 of AGS. All applications for credit are subject to ING’s credit approval criteria, and fees and charges apply. You should consider the relevant Product Disclosure Statement, Terms and Conditions, Fees and Limits Schedule, Financial Services Guide, Key Facts Sheet and Credit Guide available at ing.com.au when deciding whether to acquire, or to continue to hold, a product. Before interacting with us via our social media platforms, please take a minute to familiarise yourself with our Social Media User Terms https://www.ing.com.au/pdf/Social_Media_User_Terms.pdf.