How to find your Client Number and Access Code

How to register for the new ING app

Jump to a section

Downloading the new ING App

1. Client number

Once you have accepted the terms and conditions, you will be asked for your client number.

Your unique client number is a simple way of identifying yourself with ING.

You can easily find your client number from the following:

- The legacy ING app by clicking into the menu in the top left corner and selecting ‘My Profile’

- The back of your Orange Everyday or Orange One card

- The top of your ING account statements

- Your welcome letter you received when you joined

Legacy ING App

- Login to your Legacy ING App

- Tap the navigation menu

> My profile

> My profile - Hit the “Copy” button for easy access when you get to the new ING App

2. Your Access Code

Your Access Code is the 4-digit code that you use to log in to ING and is a security measure to verify your identity and access your account. Don’t remember it anymore? No worries, reset it on the Legacy ING App or through Online Banking.

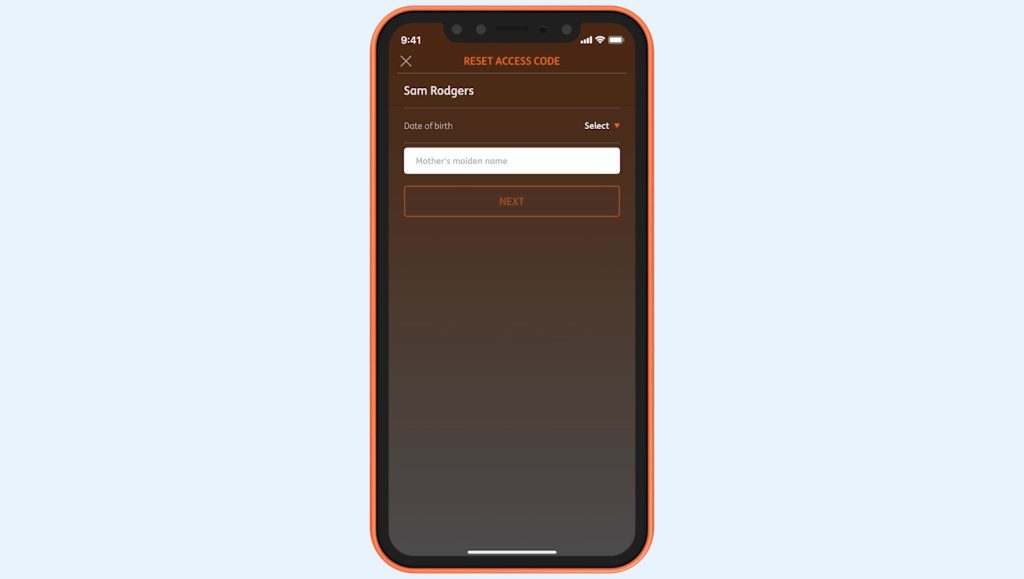

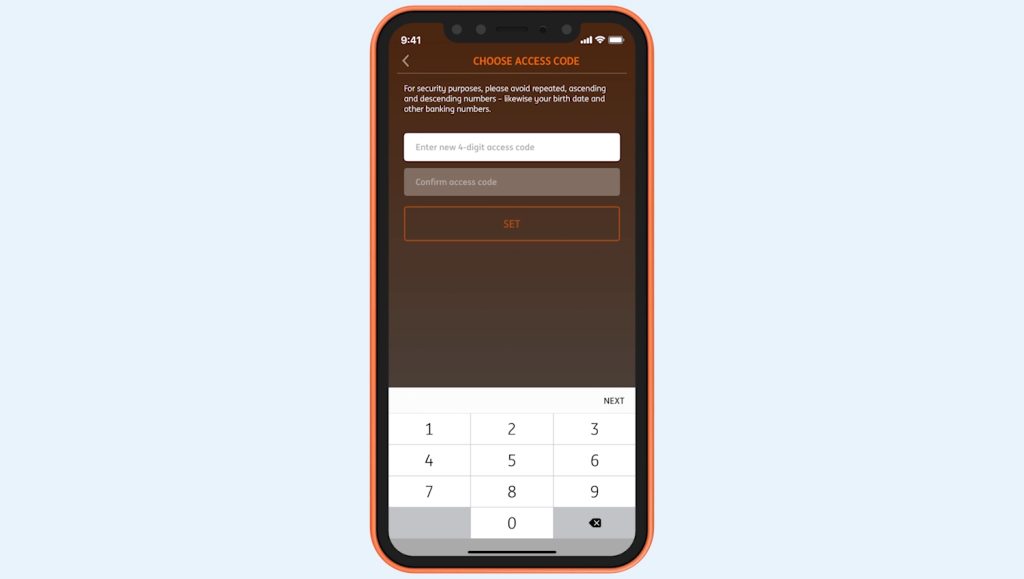

ING App

- Open the app and tap login

- Tap Forgot your access code?

- Enter your date of birth

- Enter your mother’s maiden name and tap NEXT

- Enter a new access code

- Confirm new access code

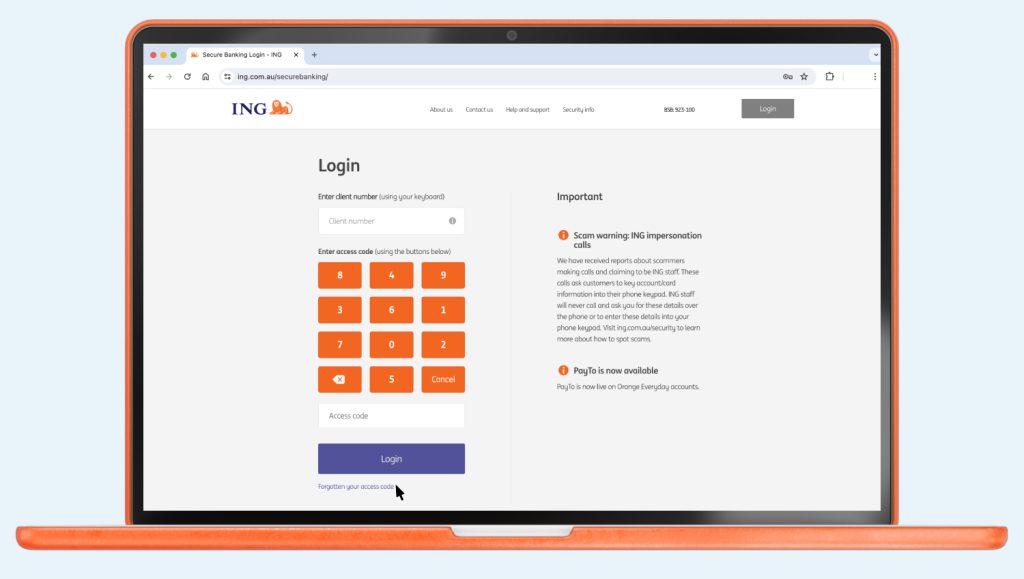

Online Banking

How you reset your access code using online banking depends on if you’ve registered to receive SMS security codes.

-

- If you’ve registered for SMS security codes

You can reset your access code by clicking Forgotten your access code at the bottom of the login screen and follow the steps.

- If you’ve registered for SMS security codes

-

- If you haven’t registered for SMS security codes

Call us on 133 464 so we can reset your access code. If overseas, please use our free call numbers from selected countries or call +61 2 9028 4077 (charges apply).

- If you haven’t registered for SMS security codes

If you’ve tried 3 times and been locked out, call us on 133 464 so we can reset it for you.

You can reset your access code using the ING App or Online Banking.

Extra secure with the new Mobile Pin

Your current 4 digit Access Code will remain essential to access online banking, customer service and to reset the app if you forget the Mobile Pin (see step 3).

3. Choose your 5-digit Mobile Pin

The new Mobile Pin is attached to the device you are choosing it on. Once set up, you will always need this Mobile Pin to access the app. Alternatively, if you activate biometric recognition, you will no longer have to enter it and you will be able to access with a glance or a finger.

4. Verify your device

For security reasons, we’ll send you an SMS security code to your registered mobile number so that you can finalise your set up. You can check that your mobile number is up-to-date and valid in My profile on the legacy ING App or in online banking. If you need to update your mobile number call us on 133 464. Alternatively, visit our Contact Us page to view our free call numbers available from selected countries. You may not be able to receive SMS security codes if travelling internationally and using a travel SIM where the phone number is different.

Having trouble receiving your SMS security code?

Check that you are registered for SMS security codes by visiting the My profile tab on online banking.

5. Your app is set up, start exploring!

You are ready to start using the new ING app. Stay tuned and be the first to use new features the moment they are released!

If there’s something you can’t do in the new app just yet, don’t worry – it’s on the way.

In the meantime, you can still use the legacy ING app or online banking to get it done. We’re working hard to bring everything together in one place soon!

From now on, you will be able to access the new ING App with the 5-digit Mobile Pin you chose.

What if you forget it? Click here.

Or with biometrics if you have activated it.